November 9th, 2021 • Core Banking

7 tips for choosing your new Core Banking 💡

Choosing a Core Banking solution should not be taken lightly.

January 24th, 2023 • Core Banking

The majority of unsuccessful Core Banking System migrations have failed for three main reasons: people or culture, process, and technology.

With consumer habits going digital and competition from tech players growing, fintech companies are leading the charge, pushing financial institutions to modernize their Core Banking Systems and adapt to current trends. In response to this changing landscape, the more established financial institutions are leveraging modern technologies such as the cloud, which has been a major catalyst of digital conversion. However, many realize that their current Core Banking Systems cannot meet the demands of an ever-changing environment.

Some financial institutions are converting their Core Banking Systems (CBS) to facilitate digitization. Yet, very few of these CBS migrations result in success (such as a migration of registries and products to a new technology platform). We have analyzed a few unsuccessful CBS migrations to understand where the obstacles lie. There is no one-size-fits-all approach, but there are some common mistakes financial institutions make. While CBS migrations are complex and resource-intensive, they tend to be ad hoc, and financial institutions are not accustomed to these types of exercises.

People, or what we call resources or personnel, are the driving force in completing these migrations. However, financial institutions often fail to appoint the right people to lead them.

❌ Choosing operations personnel to lead the migration

In practice, financial institutions tend to appoint teams consisting of operations personnel to implement the Core Banking migration. But, these resources are culturally resistant to adopting new solutions and processes that are linked to the architecture. They tend to unintentionally replicate the “old” legacy processes for the “new” next-generation Core Banking solution. One answer to this dilemma is to establish a mix of internal and external implementation teams with a good knowledge of both CBS migrations and new technologies.

❌ Defining a Core Banking System migration as a purely technical migration

Most successful Core Banking migrations start with an organizational transformation, meaning putting the right people in place. The cultural migration occurs in conjunction with the technical migration. Financial institutions that rely on DevOps and agile practices (sprints, continuous integration, and delivery) have successful migrations because these require modern, flexible architectures to run smoothly.

❌ Lack of stakeholder alignment on the function and scope of the new Core Banking Platform

An organization’s business and technical teams are not always aligned on the need for migration. For example, technical teams are primarily interested in modernizing the system architecture so they can launch new features and products more quickly. By leveraging the reduced time to market, the business teams want to increase revenue, and the financial teams want to reduce overall costs. These different priorities lead to a disconnect in interests, making the migration project more complex. To achieve genuine agreement among the stakeholders, the financial institution must find an objective implementing partner who will guarantee successful project execution.

Inadequate planning and the desire to retain legacy processes and applications siphon off committed resources and slow down the Core Banking System migration.

❌ Planning and implementation that takes years

Another major source of failure is the planning and implementation phases, which tend to end with waterfall-like "go-lives." Among financial institutions, the planning phase can take several years (2-3 years) and the implementation phase between 4-10 years. Regulatory and technical requirements evolve and change so fast that the "go-lives" become obsolete, and the project is doomed to failure.

❌ Lack of transparency on costs incurred and the implications for Core Banking System migration

Financial institutions are always prone to product disruptions or delays due to costs incurred or resource shortages. Indeed, stakeholders want to avoid divulging skyrocketing costs for fear that the migration project will come to a halt. The same goes for migration stability issues that are not communicated and can lead to significant delays.

❌ Using legacy components and applications in a new Core Banking Platform

Some financial institutions do not have a plan to decommission legacy applications, processes, and products because they want to keep them running in an attempt to reduce the complexity of migrating from the legacy Core Banking System. This approach creates the opposite effect and tends to increase costs considerably over the long term. The intricacy of the Core Banking System migration further adds to the financial institution’s IT burden. In addition, these legacy applications are only running at 10% to 20% of their capacity 3 to 5 years after the implementation of the new Core Banking Platform.

The wrong approach to vendor selection or application customization capability can significantly impact a new Core Banking Platform.

❌ Choosing key partners based on price

Financial institutions often choose their technology providers based on price rather than product capability, or banking and regulatory experience. These vendors might underestimate the intricate requirement and invest too much time and resources without really considering whether it meets the specific needs of a financial institution. The consequences are numerous, including unnecessary customization of standard products, complex interfaces, changes in project scope, and so on.

❌ Do not convert your Core Banking System by adopting a Core Banking Platform

In the medium and long term, customization increases, leading to complications in modifying the Core Banking System, decreasing potential efficiency gains. For example, financial institutions underestimate the time required to integrate the Core Banking Platform with back-office applications, resulting in budget overruns and complicated interfaces. Similarly, financial institutions are unaware of the features missing from the new technology platform. Resolving this lack of clarity requires enhanced and accurate training to avoid causing project delays. However, financial institutions that launch an independent digital bank alongside the legacy Core Banking System will not encounter migration problems.

The financial institutions that avoid these mistakes are more likely to succeed in their Core Banking migration.

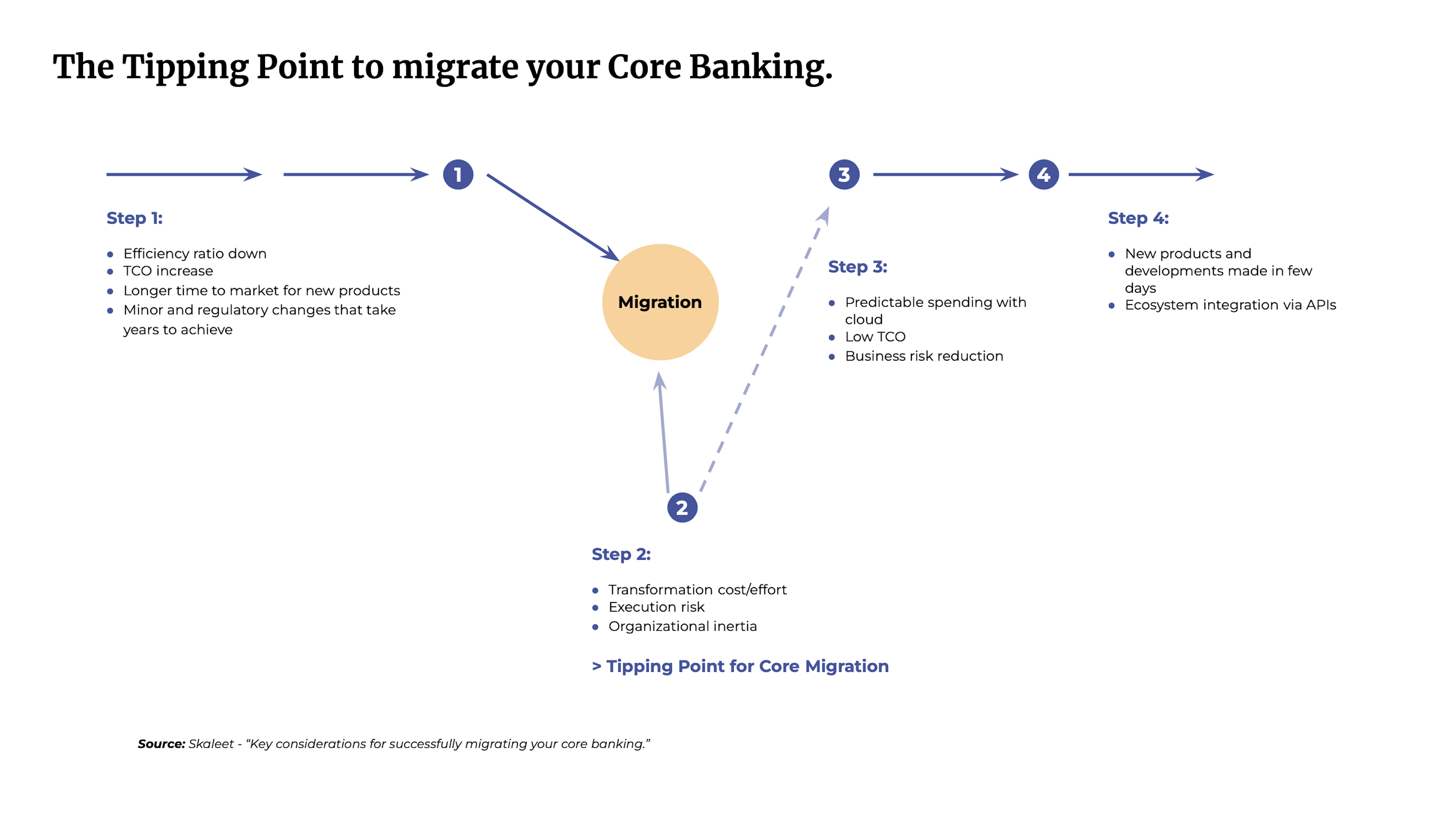

Due to a competitive landscape that is becoming more and more diverse, financial institutions are now under increased pressure. New entrants, such as fintech companies, neobanks, and big tech companies, are on the cutting edge of technology, especially regarding technology stacks and operating models. Many financial institutions struggle to find a competitive advantage but are bogged down with legacy Core Banking Systems. This significantly hinders their level of performance and reduces agility. In addition, they continue to consume large amounts of human and financial resources, all of which contribute to a lack of concrete initiatives to address regulatory issues and new customer needs. While legacy Core Banking Systems are at the heart of a financial institution's operating model, they have become a significant burden to them. Meanwhile, neobanks and fintech companies rely on cloud-native Core Banking Platforms, which can reduce their cost base by nearly 70%.

As the need for modernization becomes more and more pressing, financial institutions need to rethink migrating their Core Banking Systems. Large migration projects and the associated costs—not to mention organizational inertia—are obstacles to successfully migrating a Core Banking System. As legacy technologies’ shortcomings become more and more noticeable, the cost of inaction will become more and more consequential. Large migrations will be even harder to justify and will begin to be replaced by more modern, cloud-native methods for gradual migration. As the business case becomes easier to make, more financial institutions will realize that it is worth taking the risk.

Many financial institutions are now considering incremental approaches that introduce a notion of modularity into the business model. While a traditional migration process manages project risk and maintenance costs, a cloud-native approach dramatically reduces the time required to get a Core Banking Platform up and running because certain stack components can be migrated over time. The Core Banking Platform’s flexibility and the cloud’s resilience make financial institutions more profitable. Once operational, recurring maintenance costs can drop by more than 75%.

Here are some key points regarding a cloud-based Core Banking Platform, such as Skaleet’s Core Banking Platform, that help reduce the Total Cost of Ownership (TCO):

Over the next few years, competition in the banking industry will require financial institutions to rely on modern technology platforms such as cloud-based Core Banking Platforms. Financial institutions must consider the direct and indirect impact of the cost of operating a legacy Core Banking System. Financial institutions must decide for themselves how to modernize, but the need to do so has never been greater.

Innovation. FinTech. Digital Banking. Neobanks. Open Banking. Core Banking. Cloud.

November 9th, 2021 • Core Banking

Choosing a Core Banking solution should not be taken lightly.