September 1st, 2022 • Technology

Meet Us At Amsterdam Fintech Week! 🤝

Skaleet is participating in Amsterdam Fintech Week!

September 6th, 2022 • Payments

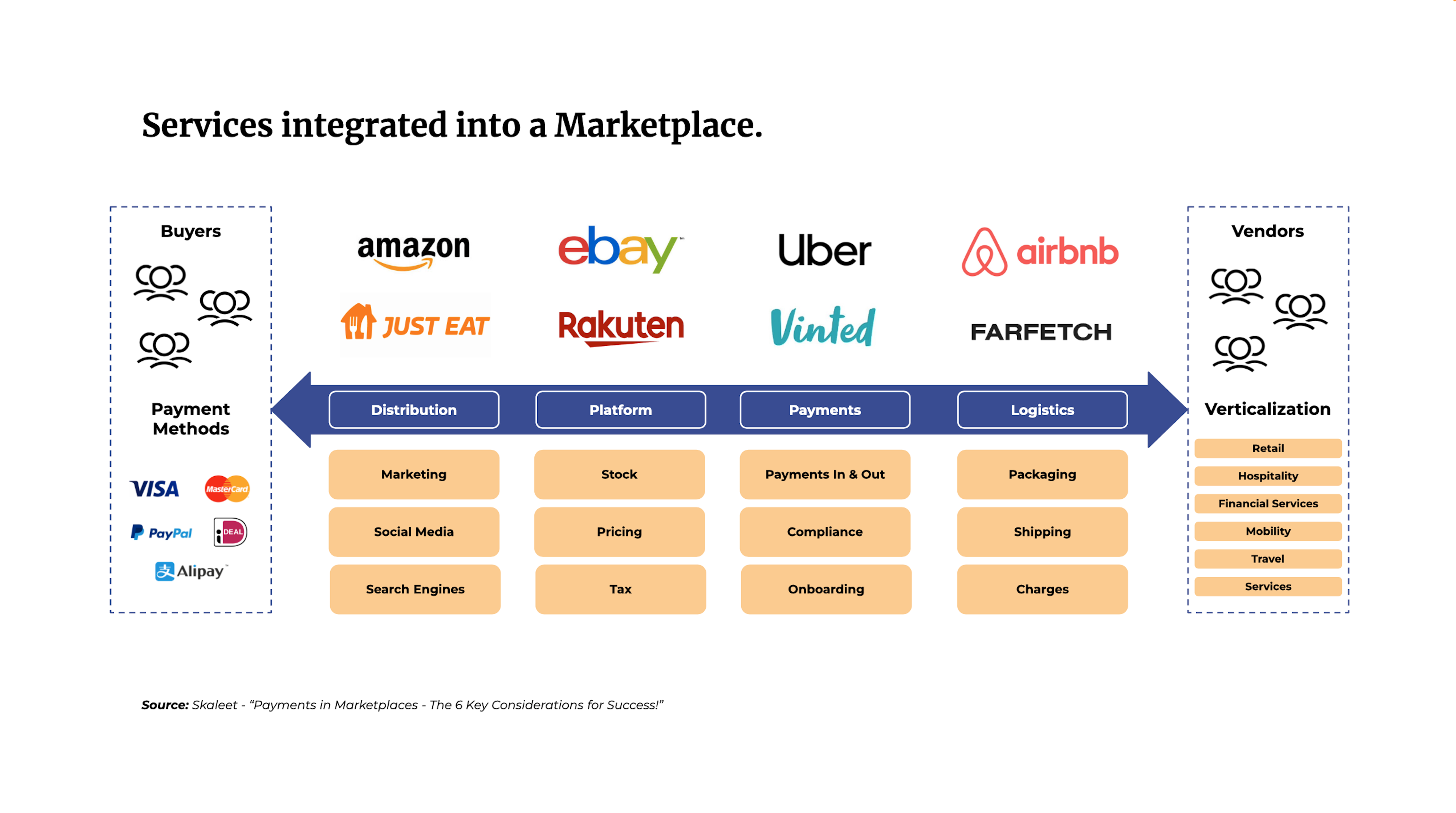

The COVID-19 pandemic is thrusting the digital world to the forefront, relegating bricks and mortar operations to second place. Online marketplaces are playing a central role in this dynamic. The marketplace business model has been steadily evolving over the past twenty years and has become an essential tool in digitizing and diversifying sales channels in many business sectors, their model has been constantly changing for twenty years. The early 2000s saw the emergence of the first platforms, like eBay and Amazon, connecting millions of buyers to millions of merchants. Since then, new platforms such as Uber, Airbnb, and Booking.com have appeared on the market. The notion of a marketplace shows that it is no longer just an e-commerce approach, but also a verticalized offer, able to adapt to different industries such as mobility, hospitality, or also services. Most people think of the traditional eBay model (B2C), forgetting that there are so many others. Indeed, B2B is enjoying tremendous success due to its ability to support the growing demand for goods worldwide. B2B2C and C2C are also marketplace models that should not be overlooked, especially with the creation of peer-to-peer models and new monetization and even financing models.

Marketplaces offer SMEs access to a global network of buyers at a low cost. Indeed, they are able to provide marketing tools and SEO optimization, they also offer access to an existing market with millions of buyers, payment processing, as well as dispute resolution, and services such as shipping and logistics. Marketplaces provide SMEs with a turnkey solution. All they need to do is choose the brand that best suits a target market. The value of the model means that some players do not rely on existing markets but seek to build new ones on their own and capitalize on developing their customer base.

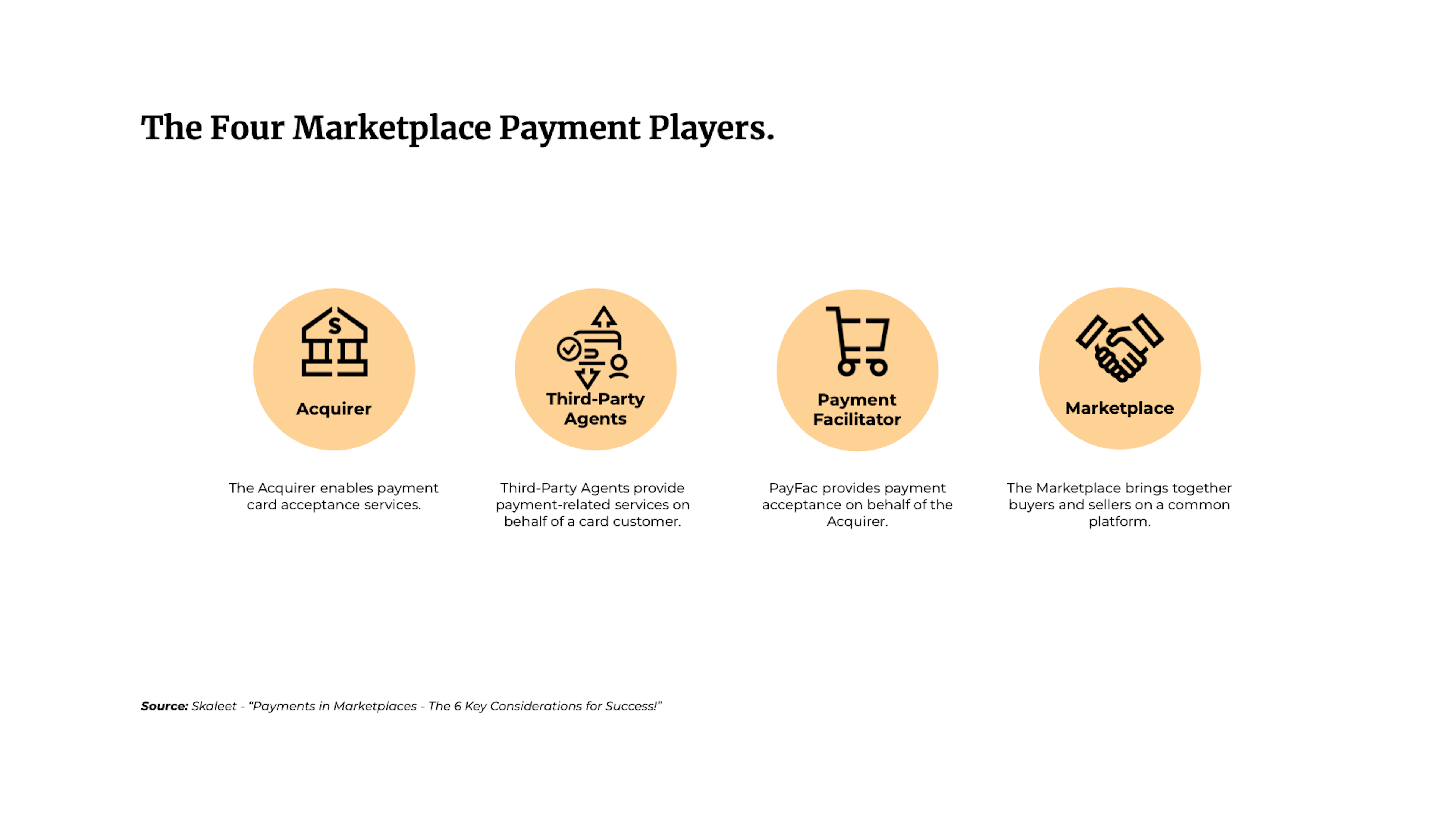

In today's world where payments and technology have merged, many fintech companies have entered the payments industry in order to bring new value propositions to marketplaces. Third-party agents, payment service providers, acquirers, or payment facilitators ... all want to play a unique role in the e-commerce that takes place between buyers and sellers. A fundamental aspect of risk management, particularly with respect to payment facilitation and marketplaces is understanding the distinct role of each entity involved in the payment ecosystem.

The Acquirer - An Acquirer is a customer of a card network (e.g., Mastercard or Visa). The primary role of the acquirer is to maintain complete oversight of those they sponsor. An acquirer must continuously monitor payment facilitators and marketplaces to ensure compliance with card network standards.

Third-Party Agents - These are entities that contract with the card networks to provide payment-related services. This includes organizations that store, process, and transmit transaction data to card networks. Payment facilitators and marketplaces can be third-party agents, but this requires sponsorship and registration with an acquirer.

Payment Facilitators - Also known as a "PayFac", a payment facilitator is a third-party agent that contracts with an acquirer to provide payment services and solutions on their behalf. Payment facilitators enter into payment services contracts with merchants and sub-merchants to provide payment services. The acquirer is not a party to these contracts but will deposit settlement funds directly with the payment facilitator. The payment facilitator will then disburse these funds to its merchants and sub-merchants.

Marketplaces - Marketplaces are third-party agents that bring buyers and retailers together via a single platform, i.e., a website or mobile app. Marketplaces process payments and receive funds on behalf of merchants. Entities that do not process transactions on behalf of merchants are not considered to be marketplaces. The marketplace must contract with the acquirer to accept payments. The marketplace also manages the customer experience, accepting payment on behalf of the merchant and issuing a transaction receipt, even if the customer buys from multiple merchants in a single transaction. The marketplace also handles refunds and disputes between buyers and merchants.

While marketplaces represent a fantastic opportunity, the barriers to entry are increasing due to a transforming industry and a demand for compliance that is increasingly affecting both new entrants and established players.

1 - Payment Regulations

The advent of PSD2 has forced many of these companies to factor in regulatory overhead to continue operating. First, you need to determine the regulatory model in which you want to operate, either by becoming a payment institution, a payment facilitator, or an electronic money institution. Each of them has its own challenges, constraints, and opportunities in developing payment services. This is a significant change that impacts the entire business of a marketplace, from how a vendor will be integrated into the business, to how incoming funds are managed, to monitoring how funds flow through the systems. The new rules are governed by KYC (Know Your Customer) and AML (Anti-Money Laundering). Moreover, becoming a regulated marketplace in a local market is merely the initial challenge; these rules must be taken into account for all geographical areas in which the marketplace intends to operate. All have different rules that must be considered.

2 - Integrating customers and merchants into the marketplace

The transition to a regulated marketplace requires new thinking, including defining spending limits and risk rules to be applied, as well as documents to be gathered and approved in order to provide access to a new vendor. This approval process is essential and requires marketplaces to obtain information about merchants to prove to the regulator that you know them. In addition, you must closely monitor your users and be able to provide additional evidence or documentation to approve business activity that does not correspond to a business model, a value, or other rules.

3 - Pay In: managing incoming payments

Most major marketplaces are internationally oriented, and any global e-commerce solution will generally have to include a growing list of payment solutions that consumers are looking to use. Your marketplace should support the major payment card networks in the countries or regions where you operate, such as Visa, Mastercard, Amex, etc., in order to optimize business. These card networks should also work locally considering APM networks (Alternative Payment Methods) such as iDEAL, POLi, SEPA, and potentially others. Payment wallets are also popular with consumers and can have a major impact on payment conversions. Paypal, Alipay, Venmo, and even Wechat are popular with solutions like Apple Pay and Google Pay. And finally, we must not forget that new payment and financing methods are emerging in the markets, such as Open Banking and BNPL. It is essential to be in compliance with applicable regulations, as many payment systems are changing their rules regarding marketplaces. Non-compliance may prevent you from processing payments in certain regions.

4 - Managing disputes and refunds

As regulatory entities, companies are subject to scrutiny with respect to managing disputes and refunds. The marketplace is subject to AML rules which require it to have robust processes in place. It's also worth noting that there are challenges associated with the many APMs that exist. Many do not offer refunds, which forces marketplaces to design new rules and processes to facilitate these refunds.

5 - Pay Out: managing outgoing payments

Modern and sophisticated marketplaces allow merchants to sell anywhere in the world. The payment process may therefore involve multiple merchants selling in multiple currencies for a single buyer. This creates a complex network of exchange calculations and fees that must be carefully tracked and integrated into the system in order to generate payments in multiple currencies to multiple countries. Another consideration is balancing accounts across different regions of the world. If a large number of payments were made in Europe and the merchants that need to be paid are located in the US, then you need to move money between accounts. To compound this issue, merchants want to get paid quickly, so you need to take this into account when designing your systems. In addition, you must be careful not to fall into the regulatory trap of giving loans to your merchants.

6 - Tax

Marketplaces are now responsible for collecting taxes and making payments to the respective agencies in the respective countries. It is no longer the seller's responsibility, although you must provide the seller with the means to demonstrate that the tax has been paid. This complicates matters significantly as most countries have their own set of rules. Once the tax amount is established at the time of payment, you also must consider logistics, such as import and export duties that may apply, and provide the necessary tools to assist merchants in this process.

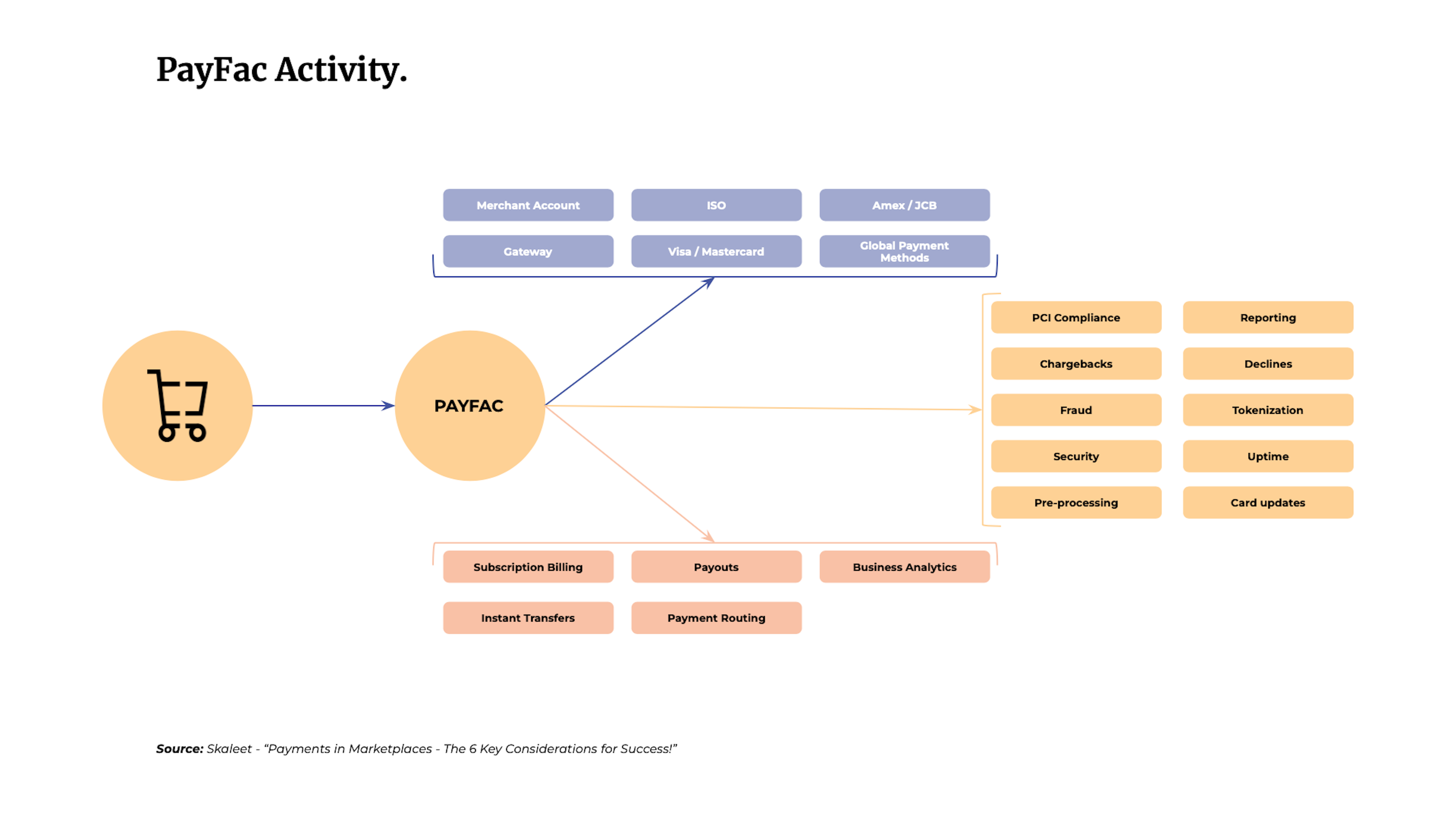

The expansion of marketplaces has allowed the emergence of integration of payment services via the PayFac concept. Marketplaces are more than the aggregate of a payment gateway and a payment acquiring manager. They also offer merchants turnkey solutions for ingoing and outgoing payments, onboarding, KYC and AML, taxation, and more. Technology has fundamentally changed the way businesses, payment acquirers, and card networks work together. The rise of SaaS platforms and marketplaces has accelerated change. Increasingly, they connect buyers and sellers in new ways, adding payment and financial services capabilities, and creating new shopping experiences. Today, many platforms and marketplaces help merchants accept payments by providing online services to businesses of all sizes. In order to differentiate their product and create stickiness, marketplaces have made payment functionality an integral part of their platform. As such, participating merchants no longer need to establish direct relationships with acquirers and payment gateways.

While each type of platform or marketplace is different, many have made payment an essential part of the customer experience. Increasingly, they are using payment capabilities to differentiate their offerings and brand, strengthen customer relationships, and monetize transactions on their platforms. To date, there are two "in-house" models for integrating payments:

The PayFac model emerged to help payment companies reduce the start-up complexity of online payments and offer services to a broader range of businesses, thus allowing them to focus on their core competencies.

Skaleet's Core Banking Platform helps marketplaces launch their PayFac solution by opening a merchant bank account and receiving a merchant category code (MCC) to acquire and aggregate payments for a group of smaller merchants, typically called sub-merchants. Marketplaces that leverage the PayFac strategy will have an integrated payment system and their primary MCC registered at an acquiring bank. Sub-merchants, on the other hand, are not required to register their unique MCCs. Instead, transactions are grouped under the marketplace's main PayFac MCC. This is intended to reduce the complexity sub-merchants would face when setting up online payments on their own, as it eliminates the need to establish and maintain relationships with an acquiring bank, a payment gateway, and other service providers.

The Core Banking Platform will also allow you to:

While these four categories are clear, it is difficult to find a consistent description of a PayFac’s granular responsibilities. Each acquiring bank has different rules. These guidelines together form a complex web of requirements between card networks and banks. Think of a payment facilitator as a regulated entity that manages card network relationships, sub-merchant onboarding, and payment services for merchants. The PayFac directly manages the payment of funds to sub-merchants.

If you are a marketplace or are considering becoming one, you have some important decisions to make. The first question to ask is, “Do I build, or do I take on a partner?” There is no single answer. Industries, geographic regions, and certain marketplace’s inclinations will likely define the best decision. One thing is for sure: the popularity of marketplaces and PayFac integration is only increasing.

Innovation. FinTech. Digital Banking. Neobanks. Open Banking. Core Banking. Cloud.

September 1st, 2022 • Technology

Skaleet is participating in Amsterdam Fintech Week!