March 16th, 2021 • Neo banks

9 steps to creating a digital bank from scratch 👨💻

The Core Banking is the most vital part of a digital bank. In fact, it is the essence of a digital bank.

April 13th, 2021 • Neo banks

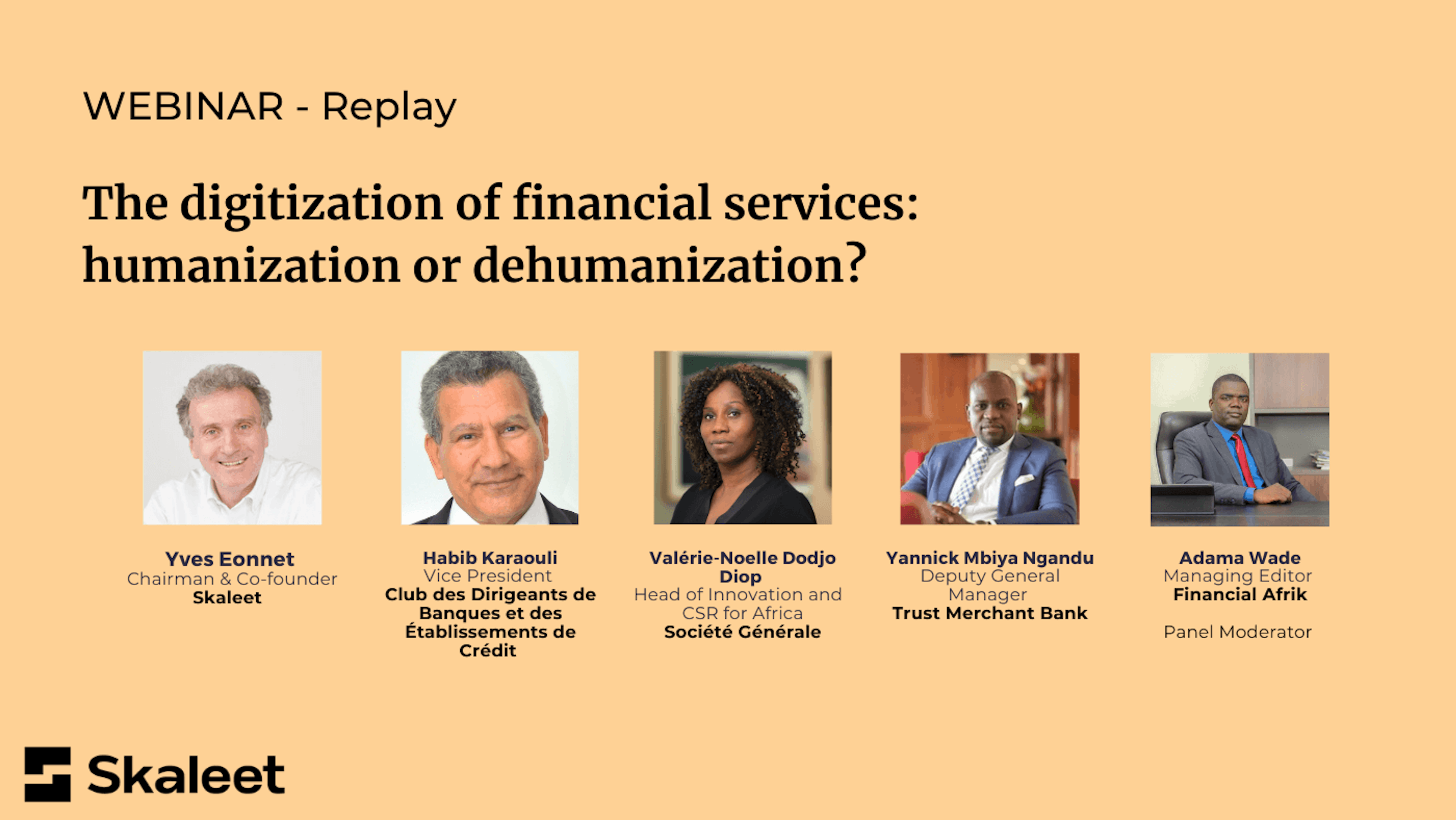

Organized by Skaleet in partnership with Financial Afrik and Blue Jay Communication, the webinar “The digitization of financial services: humanization or dehumanization?” held on April 7th reached all its expectations. First, thanks to all the audience composed of financial players from the sector who followed the debates from the beginning until the end. Then, the high quality of the panel moderated by Adama Wade (Financial Afrik) and panelists such as Yves Eonnet, Skaleet’s CEO and Co-founder, Valérie Noelle KODJO DIOP, Innovation and CSR Director for Africa from Société Générale, and Yannick MBIYA NGANDU, Deputy General Manager of Trust Merchant Bank.

The Skaleet CEO states that the Core Banking Platform contributes to being an essential break for the Core Banking System. In the beginning, digital transformation was against banking humanization, and now we are going to reach a reinvented, personalized, and tailored relation with the client. “But the author of “Fintech: The banks strike back” warns, we are clearly under the risk of leaving the clients alone in front of their screens. Digital must allow banking to come back into our daily life.”

The humanization of financial services refers to the role of the bankers, agents, and customer service representatives. An opinion shared by Valérie Noelle KODJO DIOP “In a pandemic where new barbaric words like social distancing” the digital “rehumanizes relationships”. A good example is the “YUP” model which apart from proposing financial services it also offers daily life services such as medical diagnosis. The Innovation and CSR Director Africa from Société Générale considers that CBP re-enchant the bank and create links. She confirms, “the digitization, which means at your fingerprints “ and “humanization, which etymologically means to put the banking at the hands of everyone, are met up.” The other panelist, Yannick MBIYA NGANDU, could not agree more, looking at the bigger proximity to the digitization and the agile synonym of financial inclusion. The popular concept of agency banking, the banks approach to people is opposed to the old bank waiting for the client in its branches. In the old banking model, “we were faced with a system that was not adapted to the African population,” affirms Yves Eonnet, who believes that today, every consumer has a phone in his pocket, which changes the relationship considerably. 📱

Skaleet's tools enable faster access to data and to quickly respond to the customers' needs. The most expensive feature for traditional banks is the distribution cost, which reminds Valérie Noelle KODJO DIOP. «Today, the goal is to reduce this acquisition cost by implementing alternative models while providing the resources to move around in the client's ecosystem». In the DRC environment where connectivity is not at the same level everywhere, agility is a significant part of digitization. “The keyword is the multichannel” claims Yannick MBIYA NGANDU. “Beyond promoting important economies of scale, Skaleet solution allows us to touch our clients through multiple channels: SMS, USSD, WEB, application mobile, etc. Being able to offer the same product but using different channels enables us to respond to the challenge of connectivity”. If there is a banking digital model adapted to Africa, it must offer as many alternatives as possible to the customers.

It has to be recognized that the Covid-19 pandemic started in March 2020 has accelerated digitalization, and rocketed the need for dematerialized financial services. As Yannick MBIYA NGANDU reminds, "Digitization is a journey” where the banking agent has a more personal relationship with the customer, more cultural, and more human than the banker. It also seems that we are just at the beginning of this big path. “The great amount of data (Big Data) enhances the conception of new and less costly business models as they have been built in the cloud, free of hardware infrastructure, and enable a big mutualization”, adds Yves Eonnet. In the open banking era, the bank's center of gravity has been oriented to the marketing client and the distribution. "The use rather than the production" as Valérie Noelle KODJO DIOP will specify. On this last point, the digital allows the bank to manage more volume of processing of the credit application and more disbursements that will be tailored, with a better knowledge of the risk that the customer presents and, at the end of the process, less cash. In the end, everyone, the bank, the client, and the government wins. The regulator has to support and encourage the complementarities between all banking models. With possible convergences (the example of "phygital"), guarantee a harmonious and humanizing alliance between the physical world and the digital world.

Article written by Adama Wade, Publishing Director at Financial Afrik

To access the replay of our webinar, register below👇

Sign up to access the replay

Innovation. FinTech. Digital Banking. Neobanks. Open Banking. Core Banking. Cloud.

March 16th, 2021 • Neo banks

The Core Banking is the most vital part of a digital bank. In fact, it is the essence of a digital bank.