April 2nd, 2021 • Neo banks

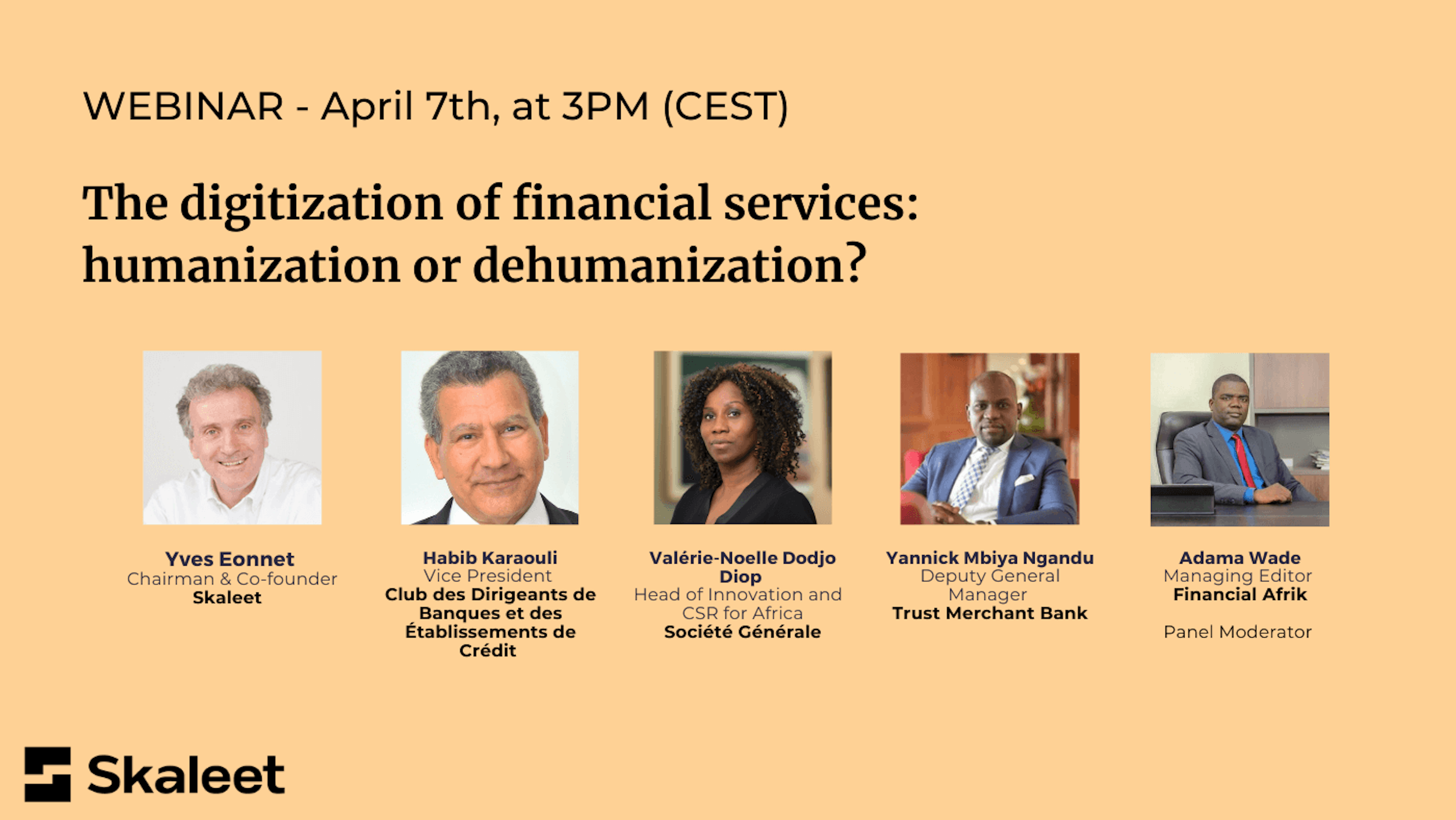

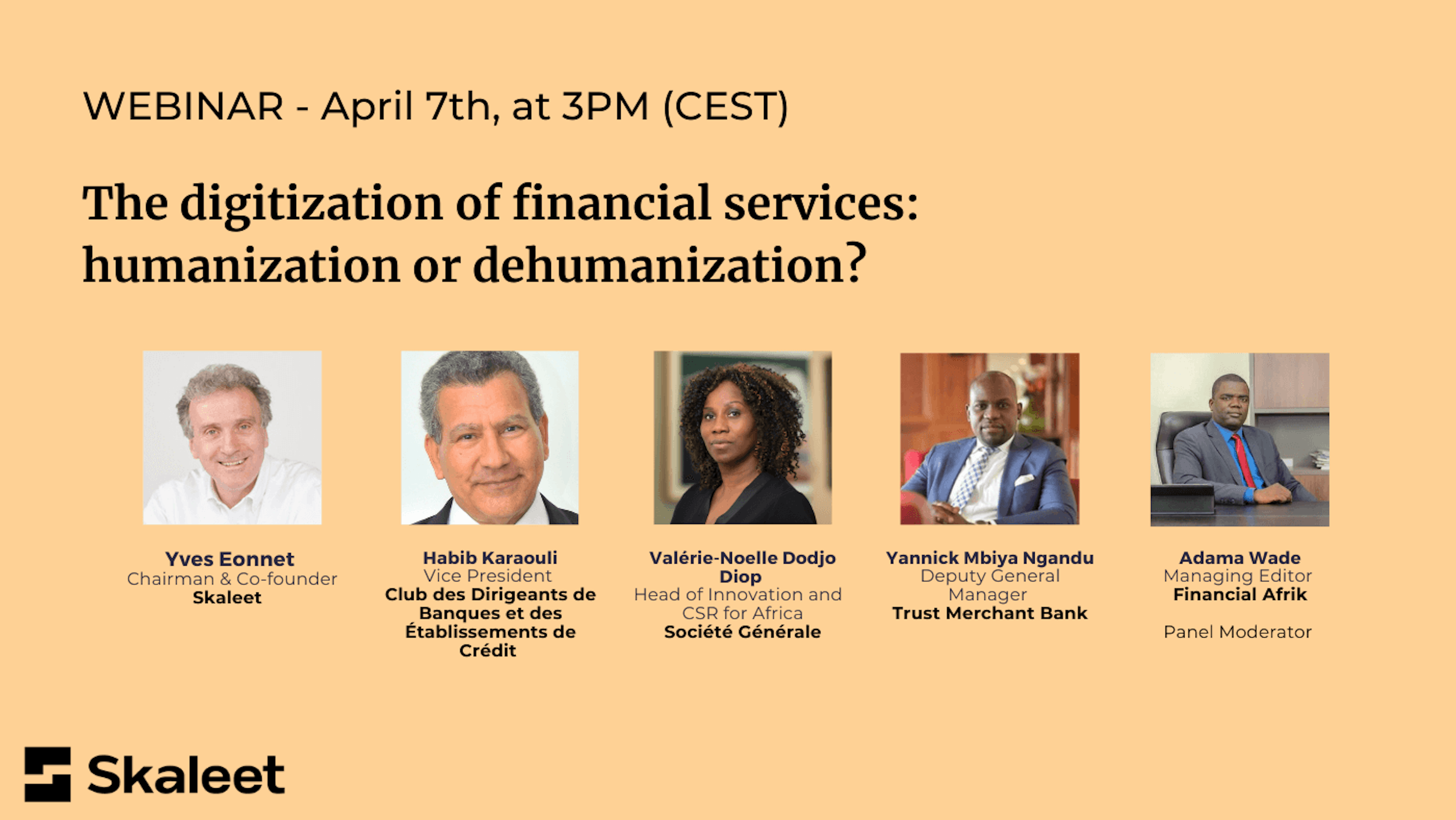

Webinar - The digitization of financial services: humanization or dehumanization?

On April 7th, Skaleet and Financial Afrik will organize a panel discussion about the Core Banking Platform...

April 12th, 2022 • Core Banking

The banking sector is constantly evolving. Customers have higher expectations, the digital revolution is ongoing, regulations are increasingly strict, processes constantly need to be streamlined, and maintenance is costly. Banks are navigating this changing environment relying on banking technology that isn’t up to the task at hand. Financial institutions have to reinvent themselves for broad, continuous change, and quickly. Long-lasting success depends fundamentally on the following: a new culture, a global strategy, new operational models, new technologies, and the willingness to change for good.

In spite of this, financial institutions are optimistic and many plan to execute transformation programs in 2022. Unfortunately, banks have been talking about transformation for over a decade and very little has changed. Resistant to real change, financial institutions remain stuck in the planning stages and don’t bring their transformative ideas to fruition for a variety of reasons:

A digital IT architecture promotes change. This is a layered architecture designed to evolve, featuring internal APIs to permit flexibility and external APIs to operate in an ecosystem. This new architecture adopts a domain-based approach by which it can create functionality (such as customer accounts) while decoupling data management. Ultimately, this architecture allows financial institutions to adopt new capabilities more quickly.

This overlay of interconnected layers allows banks to harmonize business processes or any business capabilities they need from partners. The neo-bank Starling Bank is using this approach to enrich its product portfolio while harmonizing its application landscape.

These new, Core Banking Platforms mitigate the risks associated with transformation by allowing legacy and cutting-edge applications to coexist. A tech team will no longer need to continuously modernize legacy applications.

These Core Banking Systems allow banks to access client and commercial data stored in legacy databases. By uncovering legacy data, Core Banking Platforms can access this data and create their own data stores. Data thus becomes more accessible and available.

The players offering these new solutions, like Skaleet, are leveraging new technological developments to drive innovation while supporting digital experiences, operations, and ecosystems. Skaleet removes the challenges and introduces new technologies to create frictionless experience for end users. Technology providers like Salv take care of compliance and add a higher level of security for our customers, adding to a comprehensive and unique suite of tools that Skaleet provides. Monolithic system architectures are becoming the biggest obstacle to innovation, and the layering of new systems must allow for the elimination of outdated ones. There’s an opportunity here for financial institutions:

This consists of separating what is traditionally considered Core Banking into two decoupled but interconnected elements: digitized Core Banking and Lean Core. Lean Core focuses on the availability and consistency of data. Digitized Core Banking, on the other hand, offers business competencies, processes, and even operational flows. These two applications can coexist with traditional applications/features at the time of transformation or even operate in banking ecosystems. Core Banking Platforms have evolved towards Lean Core to become increasingly flexible and, most importantly, scalable.

One of the goals of these Core Banking Platforms is to enable collaboration between banking applications that rely on different technologies. In banking ecosystems, applications and features can belong to different companies or partners. Transformational coexistence becomes necessary and often requires networks of ecosystems of applications. This ecosystem strategy allows connections between multiple Core Systems, software (SaaS), or other banking application ecosystems to assemble a hybrid solution that meets the needs of your end customers.

Innovation. FinTech. Digital Banking. Neobanks. Open Banking. Core Banking. Cloud.

April 2nd, 2021 • Neo banks

On April 7th, Skaleet and Financial Afrik will organize a panel discussion about the Core Banking Platform...